This is great. NB: At the current trend, iron is set to be worth $0 a tonne by January of 2016.

Category Archives: Economics

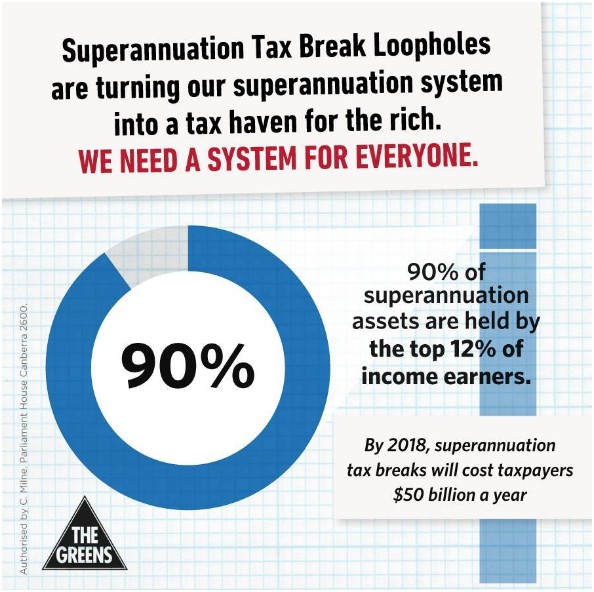

End Super Rorts? No shit Sherlock

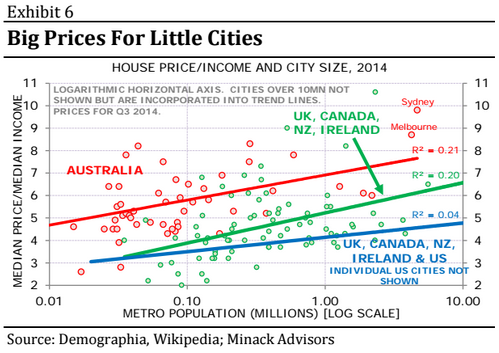

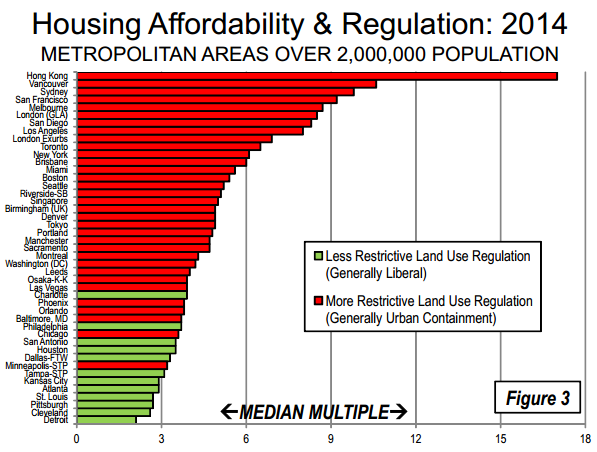

No economic rationale for Australian housing

“One of the central bankers present asked: ‘What’s going on in Australia?’ to which the research economist replied: ‘We’ve given up thinking about Australia. There is no economic rationale for it’,” he said in a Deloitte roundtable on the Australian mortgage industry.

As one MB poster puts it…

The worlds most overvalued banks

The worlds most overvalued houses

The worlds most overvalued currency

The worlds most over rated (AAA) government

(one of) The worlds largest private debt issue (s)

The worlds largest financial system exposure to mortgages

The worlds largest per capita migration intake

The worlds most profoundly uncompetitive exposed sector

The worlds most concentrated media

The worlds most spectacularly financially non viable and indebted media

The words most deliberately specious politicians when it comes to doing anything about the aboveThe worlds most utterly rooted economic narrative

Pass the popcorn, it will be a fun few years!

First Home Buyers can choose from only 5.4% of Sydney’s properties

“For Sydney, the numbers are just amazing,” said Diaswati Mardiasmo, PRD Nationwide’s national research manager. “If you have $1 million you can afford 49 per cent of Sydney but if you cut it down in half to $550,000, you can only afford 5.4-10 per cent. That’s a massive drop in terms of affordability”…

Hockey talks crap on super, gets schooled on negative gearing

Why isn’t Joe Hockey behind bars?

So we have the second most overpriced property in the world, and apparently the solution is to force younger generations to speculate on property using their retirement savings.

Nothing short of outright parasitic behaviour by a generation of self-entitled baby boomers, every economist and economic commentator has denounced the proposal. But now, PWC have some some analysis to conclude this will also blow a massive $31Bn hole in the federal budget by the year 2050.

The loss to government – which taxes earnings on super balances at 15 per cent – would be $1.1 billion in 2016-17, and fluctuate between $611 million and $993 million over the next nine years. By 2049-50, the figure would hit $2.1 billion, taking the accumulated hit to government to $31 billion, according to the estimate.

Such blatant outright corruption, at the highest level of politics in Australia.

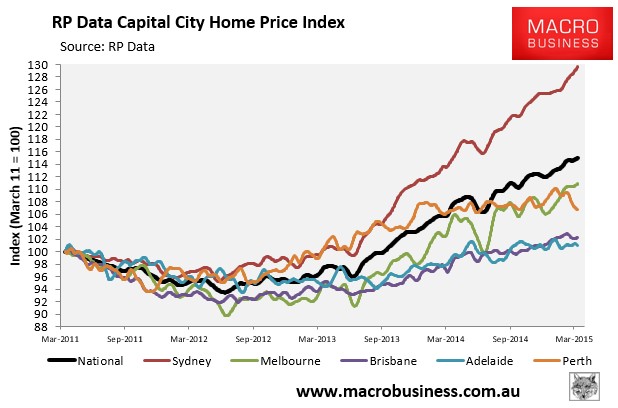

Australian property prices – so far beyond commercial reality

Aussie government does something right for a change

Imposing fees on foreign property purchases, which will be used to fund more strict monitoring of said purchases, and civil penalties for breaking the now completely unenforced and massively abused laws.

The Property Country of Australia hates the new laws, which is a big stamp of approval. Cautiously optimistic, let’s see where this takes us in 2015 and whether this halts the Sydney bubble.

Property severely unaffordable, Sydney median multiple at 10

Target the rent seekers – not the workers for tax revenue

From MacroBusiness

Most businesses in Australia would greatly benefit from a tax shift to economic rents with a commensurate reduction in company tax and the abolition of inefficient taxes such as stamp duties and insurance taxes.

Vast sums of money that are currently directed towards rent seeking would be redirected into productive activity, generating employment and diversifying the economy. Boom and bust property cycles would be flattened due to reduced speculation and, as a result, the broader scale ups and downs of the business cycle would be somewhat moderated.

JPM – BP – Bank of England Cartel Exposed

Amazing Cartel triangle between JP Morgan, British Petroleum and the Bank of England.

Bankers gone to jail for every currency rigging operation uncovered in the last year: Still 0

Scumbag government announces it will move to remove GST free threshold on BOXING DAY!

While everyone is busy with the festive season, the dark powers whom are in charge of Australia have unveiled a shocker of a policy…

Already proven to be detrimental for government revenue, in a bid to do nothing other than to protect uncompetitive economic rent seekers, the Abbott government wants to remove the $1000 GST free threshold for importing goods from overseas.

They’ve already ensured Australia is the most unaffordably expensive country to live in, with the world’s biggest housing bubble – despite having the lowest population density of any country on Earth, and now this? What a bunch of corrupt scumbags! They will not stop until they bleed us all dry..

University reforms “unfair to students”

From a speech by Professor Stephen Parker…

They emerged as a budget measure, but they won’t save the tax-payer money in any real sense.

A fundamental feature of HECS is that the Government forwards all the money upfront to the University. So if fees go up by more than the cuts, the Commonwealth shells out more from day one. Default will rise. More students will work overseas – legitimately, this is not evasion – and so only through some arcane aspect of accounting standards can this even look as if it is a savings measure.

This isn’t a savings measure: it is ideology in search of a problem.

But it gets worse. Bizarrely there is no guarantee that a single cent of the extra money will go into the student’s course: it could go into research, infrastructure, paying for past follies or current cock-ups. It’s tempting, believe me, I make them too, but it’s wrong.

The internal equity aspect of the policy design is laughable: why should the second poorest quartile of students subsidise the lowest quartile?

Central Banks & IFM – Creating bubbles, causing recessions and redistriburing capital to the rich

Truly the greatest evil.

This is an economics video largely centred around Japan – once the most successful economy in the world, destroyed very deliberately by the Bank of Japan & IMF.

Australia out of the top 10 on the corruption index

For the first time, Australia is not in the top 10 cleanest countries in Transparency International’s corruption perception index. It’s not surprising that Australia has slipped. Barely a day goes by without newspaper reports of corruption – in political parties, trade unions, sports bodies, companies.

http://www.theage.com.au/comment/australias-slide-into-corruption-must-be-stopped-20141204-11zso4.html

With nearly all member of parliament rorting the property market with negative gearing and capital gains exemptions, while keeping the rorts in place and destroying our economy in the process – is it any wonder? Not to mention all the public pork money for infrastructure projects, healthcare and education which is funnelled into private hands – like Tony Abbott’s medical research fund, designed solely to sift taxpayer money to big pharma in the US.