Category Archives: Economics

Thank you based ABC Business

Finally mainstream media does a report on housing which is not complete bullshit. By no coincidence Leith van Onselen from MB was there. I think the quality of any news piece on Australian housing is directly proportional to how much time goes to Leith to explain why everyone is retarded and doing it all wrong.

On another note, Australia is still #1 for mining investment, so disregard the mining industry propaganda and continue to tax them.

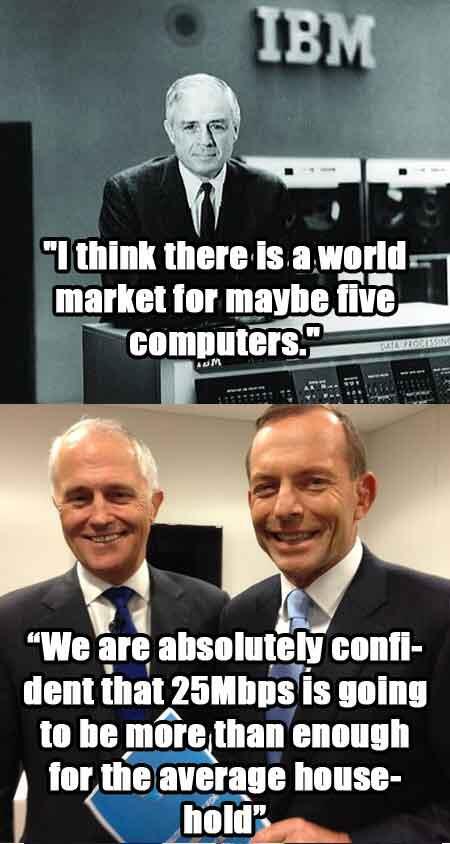

Last but not least;

>2013

>Implying I can stream Soshi 4K MVs on 25Mb/s.

The Fed gives their minutes early to the big banks

If there was any proof of blatant corruption, market manipulation and that the Fed is owned by Jewish banks, then this is it.

So long as the gap is smaller – they’d rather have the poor poorer

A great leader, a great visionary, and to me proof that even if most of them are – still, not all women are liberal hippy know-nothing pussies. RIP Maggie.

Great YT comments btw

SHE FORCED ME TO WORK AND GET A JOB! HOW DARE SHE! BURN IN HELL BITCH I BE VOTING FOR LABOUR! Because Muslims deserve more rights than me, and iEd Miliband will give me my benefits,

Here you see liberals displaying their true colours. If someone comes along promoting personal responsibility, liberals will give you death threats and when you die, launch unrelenting vulgar attacks.

Australia’s lost generation of home buyers

Australia facing a lost generation of property buyers – and apparently the government should help them with more FHOG. Yes, if by them you mean property speculators and cancerous boomers sitting on over 50% of the country’s property. Th-th-th-thanks government for creating the biggest housing bubble in the world – won’t you please make it even bigger?

As if that wasn’t bad enough, in a follow up to my earlier post about the RBA, it looks like APRA joins in by going full retard itself. Oh dear.

Is there a future for young Australians? It seems there is, but it’s a future of life-long debt slavery. For an insight as to how this will effect the Australian economy, just have a look at the Netherlands.

RBA goes full retard

Update: It just keeps getting worse…

Favourite quite;

The X & Y generations have had their country taken from under them by the baby boomer generation – their chance to live a nice life and enjoy the same urban amenity the boomers had has been stolen. There really is no other word for it.

The only Xers and Ys buying houses that i know are either getting the money from their parents or capitulating and buying a dog-box in the boon-docks.

This is and should be a war. We need to get the grimy greedy rentseeker speculators out of the market and we need to stop all the loose speculative cash the idiots from the RBA want to pump into the economy from just heading straight to residential housing.

RBA’s successful trolling through 2011 where they continuously threatened to raise interest rates – without ever actually doing it, caused record-speed paying off of the housing debt and prevented house prices from rising; many people thought that the RBA was leading Australia down a reasonably sensible path of steady deleveraging and deflation of Australia’s housing bubble. As the mining boom peaked much earlier than either the government nor the RBA predicted (largely because they are a bunch of imbeciles), many have wondered what they will do to respond. It appears that the RBA has chosen to go full retard and re-ignite the great Australian housing bubble.

RBA has now vowed to keep interest rates at whatever level they need to be to ensure that house prices rise. Given that Australia already has pretty much the highest private debt to GDP per capita, it really can’t go much higher, meaning that interest rates in Australia will probably stay depressed…for a very long time. This is obviously bad news for savers, young people, and in general anyone who doesn’t own property.

What of course they fail to understand (or perhaps don’t want to worry about because they will be enjoying their retirement in the Cayman Islands) is that this will simply damage the economy more due to more mis-allocation of resources, more indebtedness, less savings, less productivity and so on. Once the bubble bursts, the bust will be all bigger. Why delay and not just get it over and done with?

Welp, looks like it’s time to plan to move overseas to a country not ran by complete fucking retards intent to screw over all younger generations of Australians by forcing them into a life of debt servitude.

I mean really, every dollar borrowed to buy Australia’s property does a lot of damage to the Australian economy. Over a trillion dollars of borrowed money (a significant portion of which comes from creditor countries we are allegedly trying to compete with) has all but destroyed manufacturing, construction and services and promoted a largess of retail – unsustainable without easy credit and rising house prices acting as de-facto ATMs. What exactly is the end goal that they are trying to achieve? Complete destruction of the Australian economy leading to Australia joining Greece to be reclassified as a developing market? Seems like it to me.

Why don’t economists understand money?

A wonderful speech at the Positive Money conference of 2013 about how money is taught and looked at from shall we say incorrect perspectives in modern economics.

Wealth Inequality in USA

Sequestration Debate Misses the REAL Issues

Wonderful Article on why as always Congress completely fails to address the real problems of why their country is bankrupt. If you are too lazy to read…

Unnecessary military projects

Redundancy in arms and personnel

Costs which have nothing to do with defense

Waste and fraud in military spending

Wars for oil

War profiteering

Endless bailouts for the big banks

Economic policies which are destroying the real economy

Crony capitalism

Failure to enforce the rule of law, including clawing back ill-gotten gains

Shipping jobs and prosperity abroad

Paying trillions in unnecessary interest costs due to a faulty banking system

The only thing I would say is missing from the list is unsustainable entitlement spending thanks to Mr. Goldman Sachs Obama – “Healthcare is too expensive, so we gonna force everyone to buy it!”, liberal logic at it’s best. That and the aging population of fatasses.

Aussie Economics Stuff

I haven’t read the MacroBusiness superblog (the only place to get informed about the Australian economic and investment climate) in almost a month due to general laziness, and will be catching up. This post is an aggregation of interesting stuff (according to me) that has been reported on the blog in that period of time.

MB’s Presentation of Housing Supply Price Volatility – Basically cite this anytime any retard says “herp derp Australian house prices high because of not enough supply in the most sparsely populated continent on Earth”.

Australia is most uncompetitive country in the world (or to be more precise, our currency is presently the most over-valued):

How investors are causing the Australian housing market to stagnate – Simple solution: Get rid of negative gearing.

University of Australian Real Estate

Finally, we can be privy to all the secrets of what they teach real-estate agents.

There are some legit things here for sure, here are some of my favourites;

Principles of Economic Myopia and Shortage Fabrication (ECON 1019)

Fundamentals of Property Fraud (COML 2028)

Elective: Realtors – Ignoring and Returning Calls at the Most Inopportune Time (CALL2715)

Lobbying the Political Process (LUNC3001)

Misinformation and the Media (MISM3002)

Property Investment: Boasting, Ostentation & Public Smugness (WANK3016)

Land Supply and Demand in the Most Sparsely Populated Continent on Earth (BULL3471)

The Net Energy Cliff

There’s a lot of talk about the US fiscal cliff at the moment. This is a pretty short-sighted problem in my view – what everyone should really be concerned about is the net energy cliff.

A report came out today called “On the Road to Zero Growth” by Jeremy Grantham. It has some pretty thought-provoking calculations, like the following for instance;

The price rise might even accelerate as cheap resources diminish. If resources increase their costs at 9% a year, the U.S. will reach a point where all of the growth generated by the economy is used up in simply obtaining enough resources to run the system. It would take just 11 years before the economic system would be in reverse! If, on the other hand, our resource productivity increases, or demand slows, cost increases may decelerate to 5% a year, giving us 31 years to get our act together. Of course, with extraordinary, innovative breakthroughs we might do even better, but we certainly shouldn’t count on that. (Bear in mind that we don’t even know precisely why the prices started to rise so sharply in 2000.) Excessive optimism and doing little could be extremely dangerous. 1 All references to GDP growth are expressed in real terms.

For those unaware – the problem is energy is that we are living at a point in time when we are having to use exponentially more energy to get the produce the same amount of energy as before.

The debate on negative gearing heats up

For those outside of Australia (or economically illiterate in Australia), negative gearing is a tax scheme whereby the Federal government pays people who speculate on property money, thereby making property prices more expensive and collecting less tax revenue. This is done under the guise of “encouraging investing”, even though there is no investment done at all since nothing new is produced at all, in particular no new properties are built as a result. Given the absurdity of this notion you would think it’d be the first thing any reasonable government would cut from the budget, but not when vested interests and corruption are in play.